The redemption of old German bonds, particularly those issued during the Weimar Republic and Nazi era, remains a significant subject of legal, financial, and historical interest. For investors holding these bonds, assessing their financial viability and potential redemption value is a complex process that requires understanding the intricate web of treaties, legal frameworks, and post-war debt settlements that have shaped the modern redemption landscape. This article provides a comprehensive technical analysis of old German bond redemption from an investor’s perspective. It covers the historical context, legal implications, financial considerations, and practical advice for investors looking to capitalise on these instruments.

1. Historical Context of Old German Bonds

The Weimar Republic’s Financial Landscape

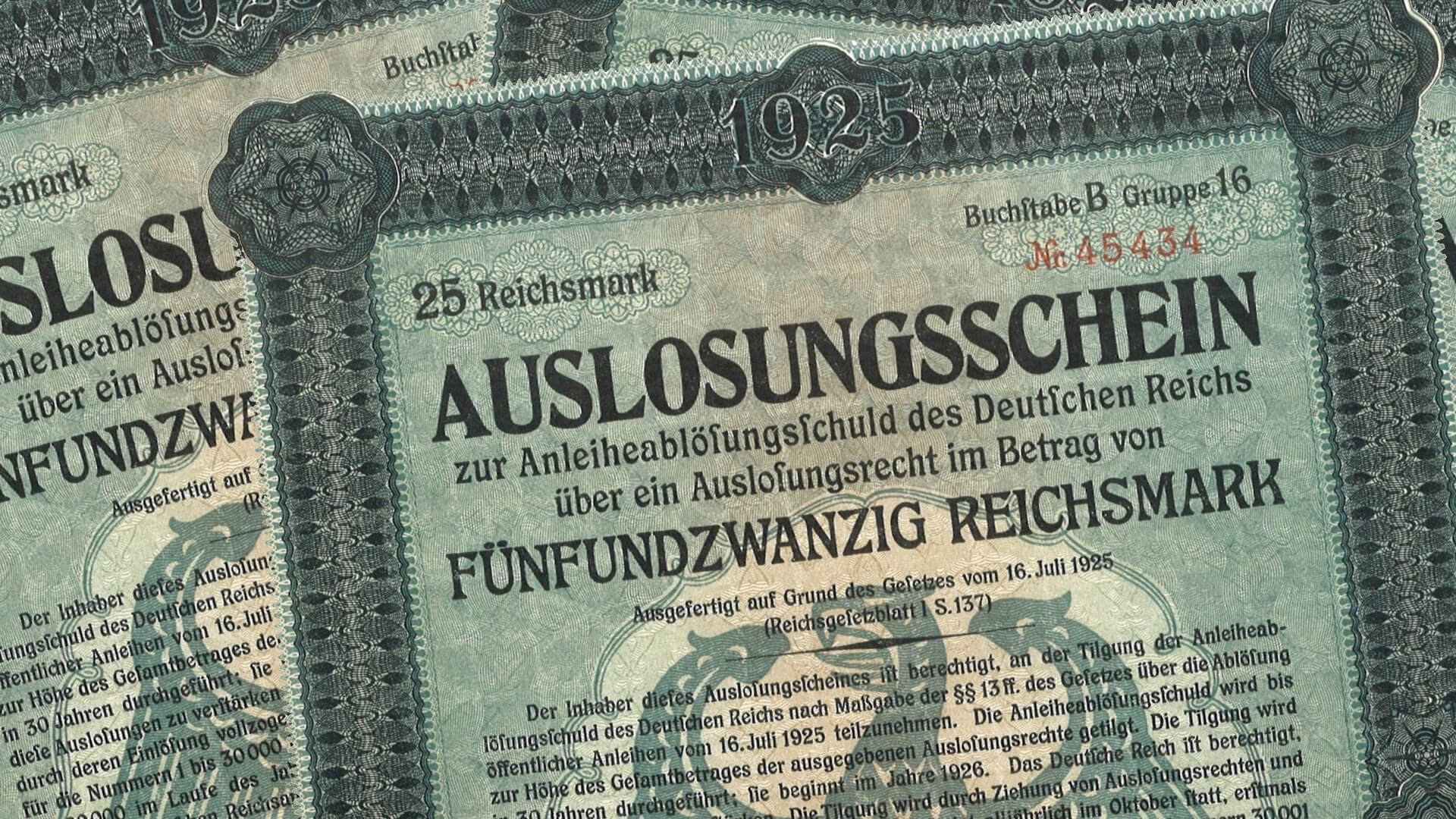

The Weimar Republic (1919–1933) faced significant financial challenges in the aftermath of World War I. The Treaty of Versailles imposed heavy reparations on Germany, which prompted the issuance of sovereign debt in various forms to meet these obligations. Among the key debt instruments were government bonds issued in Reichsmarks and Goldmarks, often marketed internationally to attract foreign capital.

Table 1 summarises the main categories of bonds issued during the Weimar Republic:

| Type of Bond | Denomination | Purpose | Maturity |

|---|---|---|---|

| Sovereign Debt (Reichsmark) | Reichsmark | Reparations payments and public expenditures | 5–20 years |

| Sovereign Debt (Goldmark) | Goldmark (foreign investors) | Stabilisation of currency, reparations | 5–30 years |

| Municipal Bonds | Local currency | Infrastructure development | 10–30 years |

| Corporate Bonds | Mixed (Reichsmark/Goldmark) | Expansion of industrial base | Variable |

Nazi Era Debt Issuance and Defaults

During the 1930s, Germany defaulted on much of its sovereign debt due to severe economic pressures, including the global depression and rearmament efforts under Adolf Hitler’s regime. The Nazi government restructured some of the debt while outright defaulting on foreign-held bonds, particularly those in Goldmarks. Bondholders from nations such as the United States and the UK were heavily impacted, leading to strained diplomatic and financial relations.

Post-World War II Settlements

Following the devastation of World War II, Germany’s financial obligations were addressed through a series of international agreements. The London Debt Agreement of 1953 was a pivotal moment in the history of old German bonds, as it deferred the settlement of certain pre-war bonds until Germany’s reunification in 1990. These bonds were subject to renegotiation, with many being restructured or cancelled.

2. Legal Framework Governing Redemption

The London Debt Agreement of 1953

The London Debt Agreement (LDA) remains the cornerstone of Germany’s post-war financial recovery. Under the LDA, Germany agreed to repay pre-war debts, but with specific provisions for bonds issued before 1933. Importantly, bonds held by foreign investors, particularly those in the United States, were included under this agreement.

Table 2 provides an overview of the major provisions of the LDA concerning old German bonds:

| Provision | Impact on Bondholders | Notes |

|---|---|---|

| Pre-War Debt (Reichsmark Bonds) | Repayable upon reunification | Deferred redemption for certain bonds |

| Nazi-Era Debt | Some debts cancelled; others deferred | Foreign-held bonds most affected |

| International Arbitration Mechanisms | Establishment of arbitration frameworks for bond disputes | Arbitration remains a key legal tool |

Post-Reunification Responsibility for Pre-War Debt

Following the reunification of Germany in 1990, the Federal Republic of Germany became legally responsible for outstanding pre-war bonds. However, the practicalities of redeeming these bonds have been hampered by jurisdictional complexities, especially when dealing with foreign courts and individual bondholders. The German government has maintained that most of the debt has been resolved through previous treaties or domestic legislation, leaving few pathways for individual investors.

Statute of Limitations and Jurisdictional Considerations

One of the biggest hurdles for bondholders seeking redemption is the statute of limitations. In Germany, claims for debt repayment are subject to time limits, and for bonds issued in the 1920s and 1930s, these limitations have often expired. Furthermore, bonds held by foreign investors are subject to the legal frameworks of their respective jurisdictions, complicating efforts to redeem them.

3. Types of Bonds and Redemption Clauses

Government Bonds: Reichsmark and Gold Bonds

German government bonds issued during the Weimar and Nazi eras were typically denominated in Reichsmarks or Goldmarks. The difference between these two forms of bonds lies in their intended holders and the currency’s stability. Reichsmark bonds were primarily issued to domestic investors, while Goldmark bonds were targeted at foreign investors and were seen as a hedge against currency devaluation.

Bonds Issued to Foreign Investors

Foreign investors, particularly from the United States, held a significant portion of Germany’s pre-war bonds. These bonds were often subject to special provisions, such as the inclusion of gold clauses to protect investors from the depreciation of the Reichsmark. As a result, the legal and financial treatment of these bonds has been different from domestically held bonds.

Municipal and Corporate Bonds

Municipal bonds, issued by cities and local governments, were typically used for infrastructure projects, while corporate bonds were issued by large industrial firms such as Siemens and Deutsche Bank. These bonds were often guaranteed by the government, further complicating redemption claims post-war. However, municipal and corporate bonds have generally been excluded from the larger redemption discussions, as most were rendered null by restructuring or liquidation of the issuing entities.

4. Investment Risks and Legal Challenges

Default History and Investor Protection

Germany’s default on its sovereign bonds during the 1930s created significant losses for investors. The impact of these defaults was exacerbated by Germany’s wartime destruction, leading to a loss of trust in the country’s financial system. While the London Debt Agreement aimed to restore investor confidence, the legal and financial environment remains complex for modern investors holding these old bonds.

Legal Battles and Judicial Precedents

Numerous legal cases have been brought against the German government by bondholders seeking redemption. In the United States, bondholders have attempted to claim compensation through U.S. courts, with varying degrees of success. The key legal arguments often revolve around the interpretation of international treaties, such as the LDA, and whether these treaties extinguish the rights of bondholders.

Table 3 summarises key legal cases involving the redemption of old German bonds:

| Case Name | Court | Outcome | Significance |

|---|---|---|---|

| US Bondholders v. Federal Republic of Germany | US District Court | Dismissed based on LDA provisions | Confirmed limits on foreign claims post-LDA |

| Goldmark Bondholders v. Germany | German Federal Court | Ruled in favour of Germany, citing statute limits | Reinforced domestic limits on pre-war claims |

| Reichsmark Investors v. Federal Republic | EU Court of Justice | Partial compensation awarded under EU regulations | Limited to EU-based investors |

5. Valuation of Old Bonds

Nominal vs. Current Value Calculations

The nominal value of old German bonds is often misleading, as these bonds were issued in pre-inflationary Reichsmarks or Goldmarks. To calculate the current value of these bonds, investors must account for inflation, currency conversions, and any historical interest that may have accrued.

Table 4 demonstrates a sample valuation approach for a Reichsmark-denominated bond issued in 1927:

| Bond Type | Nominal Value (Reichsmarks) | Conversion Factor (RM to EUR) | Estimated Current Value (EUR) |

|---|---|---|---|

| Government Bond 1927 | 1,000 RM | 1 RM = 0.51129 EUR | €511.29 |

| Interest (Accrued) | 5% p.a. (1930–1945) | Compound interest | €1,022.58 |

| Total Value | €1,533.87 |

Exchange Rates and Inflationary Impact

The exchange rate between the Reichsmark and modern currencies is a crucial consideration for bondholders. Additionally, the hyperinflation of the early 1920s severely impacted the purchasing power of Reichsmarks, leaving many bonds essentially worthless in nominal terms.

6. Current State of Bond Redemption

Recent Legal Cases and Decisions

Recent years have seen renewed attempts by bondholders to claim compensation, particularly in U.S. courts. However, these efforts have largely been unsuccessful, as German courts continue to reject claims based on the legal protections provided by the London Debt Agreement.

Redemption Mechanisms in Germany

In Germany, there are limited pathways for bondholders to seek redemption. The government has consistently argued that most pre-war bonds were either restructured or cancelled under post-war agreements, and it has resisted efforts to open new channels for redemption.

7. Financial Instruments and Opportunities

Trading on Speculative Markets

While the redemption value of old German bonds remains uncertain, there is still a speculative market for these bonds. Investors can purchase them at a fraction of their face value, hoping that legal developments or new compensation mechanisms may increase their worth in the future.

Table 5 provides an overview of recent trading prices for old German bonds:

| Bond Type | Market Price (USD) | Face Value (USD) | Discount Rate |

|---|---|---|---|

| Reichsmark Bond (1928) | $100 | $1,000 | 90% discount |

| Goldmark Bond (1931) | $200 | $2,000 | 85% discount |

| Corporate Bond (Siemens) | $150 | $1,500 | 90% discount |

8. Future Outlook for Investors

Potential Legal Developments

There remains some possibility that future legal or political developments could lead to new redemption opportunities for old German bonds. However, these are likely to be limited, given the significant legal barriers that exist today.

Prospects for Compensation and Payout

Given the legal and financial environment, most investors should not expect significant payouts from old German bonds. Instead, the value of these bonds may lie in their collectible nature or as part of speculative trading strategies.

9. Redemption Landscape

For investors holding old German bonds, the redemption landscape remains fraught with legal, financial, and practical challenges. While some bonds may have value as historical artifacts or speculative investments, the chances of large-scale redemption or compensation are slim. Investors should be cautious when entering this market, understanding the significant risks involved and the long history of legal battles surrounding these instruments.

10. References

- Eichengreen, B. (1995). Golden Fetters: The Gold Standard and the Great Depression, 1919–1939. Oxford University Press.

- Schuker, S. A. (1988). American ‘Reparations’ to Germany, 1919–1933. Princeton University Press.

- London Debt Agreement, 1953. Germany Federal Republic.