Old German bonds, particularly those issued before World War II, have long been a topic of interest for both investors and historians. These bonds, issued by the German government and various entities during the Weimar Republic and Nazi era, still circulate in the hands of private holders worldwide. However, redeeming these bonds has proven to be complex, entangled with historical debt settlements, legal frameworks, and financial viability. This article explores the history of these bonds, the legal environment surrounding their redemption, and the current prospects for bondholders.

A Historical Overview of Old German Bonds

Germany’s financial situation after World War I was marked by significant instability. In the wake of the Treaty of Versailles, the Weimar Republic was tasked with paying vast reparations to the Allied powers, leading to the issuance of bonds to raise funds. Many of these bonds were sold internationally, especially in the United States and other European nations. They were often seen as a secure investment backed by the German government.

During the 1930s, as the Nazi regime came to power, Germany defaulted on many of these obligations, citing economic hardship and the global financial depression. With the onset of World War II, debt repayment stopped entirely, and after the war, the division of Germany into East and West further complicated the situation. The Federal Republic of Germany (West Germany) eventually took responsibility for pre-war debts as part of post-war reconstruction agreements.

The London Debt Agreement of 1953

A turning point in the fate of old German bonds came with the London Debt Agreement in 1953. This agreement, reached between West Germany and its creditors, sought to restore Germany’s financial credibility and facilitate the country’s reintegration into the global economy. It covered both pre-war and post-war debts, but it deferred the settlement of bonds issued before World War II that were held by individuals or entities in countries involved in the war.

Under the London Debt Agreement, West Germany agreed to repay its pre-war sovereign bonds, but certain categories of bonds, such as those issued during the Nazi period, remained largely unaddressed. Additionally, the agreement stipulated that holders of pre-war bonds could only claim redemption once Germany was reunified—an event that finally took place in 1990.

Reunification and the Legacy of Old Bonds

Following Germany’s reunification in 1990, the country became legally responsible for the outstanding pre-war bonds that had been frozen under the London Debt Agreement. In theory, this meant bondholders could seek repayment. However, the reality has been far more complicated. Many of the bonds were no longer recognized due to previous debt restructurings or legal provisions that effectively nullified certain claims.

In practice, the redemption of old German bonds issued before World War II has been limited. Germany has paid off some categories of bonds, particularly those issued to major institutional investors and governments, but individual bondholders have often struggled to receive compensation. The German government has taken a cautious stance on the matter, arguing that most of the bonds were effectively rendered null by historical debt agreements or that they had been restructured into new bonds, which have since been redeemed.

Legal and Financial Complexities of Bond Redemption

The legal framework governing the redemption of these bonds is intricate and involves both international law and domestic German legal provisions. Bondholders seeking repayment often face the following obstacles:

- Statutes of Limitations: Many legal claims are subject to statutes of limitations, and for bonds issued in the 1920s and 1930s, these time limits have long expired. Even in cases where bondholders may have legal standing, courts often reject claims based on the expiration of the limitation period.

- Historical Debt Settlements: Various treaties and agreements, including the London Debt Agreement, have led to the restructuring or cancellation of debt. Germany maintains that the bonds were either paid off under these agreements or were effectively nullified as part of the broader post-war financial settlement.

- Missing Documentation: Many original bond certificates were lost or destroyed during the war. Without the physical bonds or proper documentation, claimants find it difficult to prove ownership and pursue redemption.

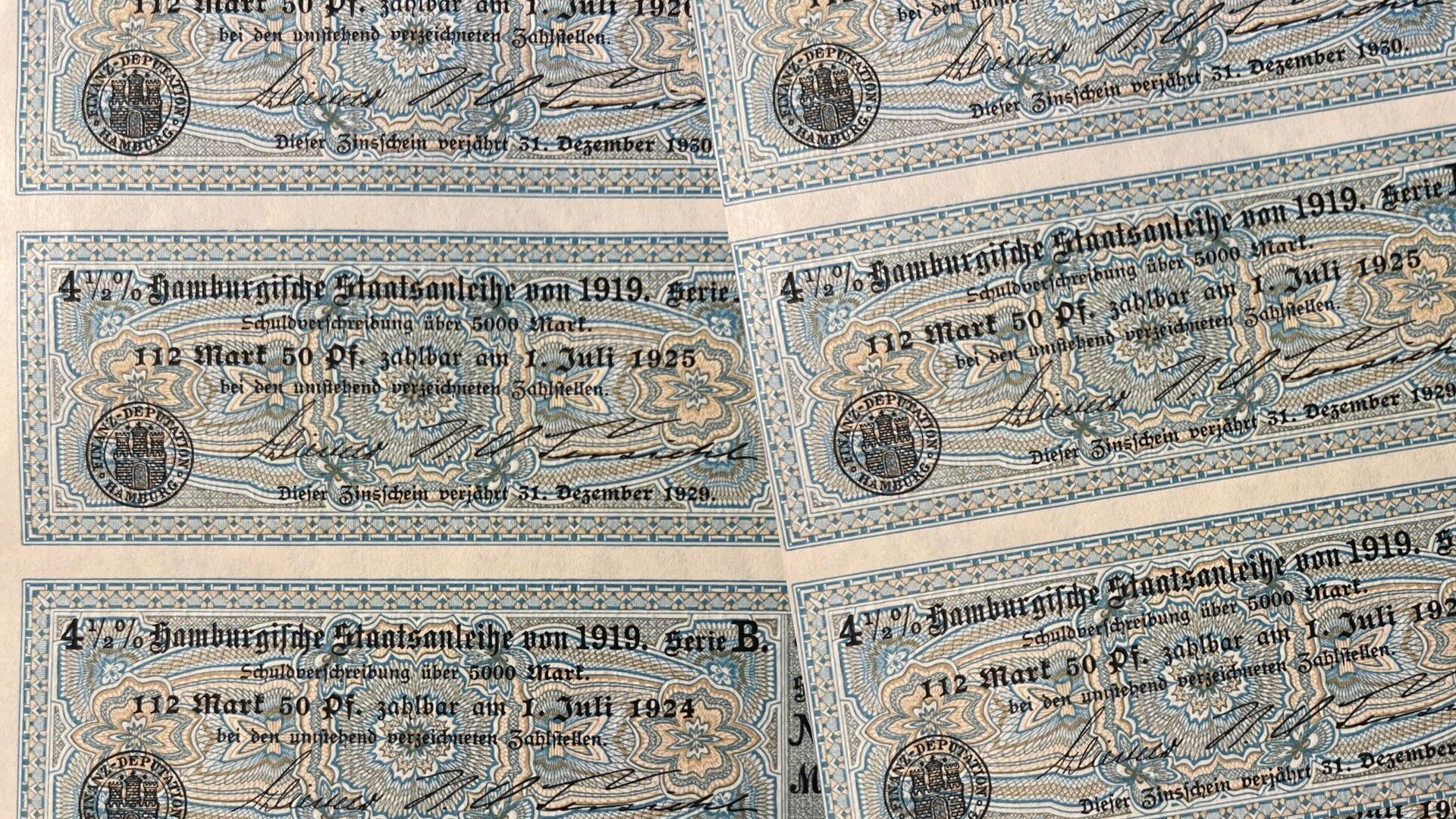

- Denomination in Reichsmarks: Many of the bonds were issued in Reichsmarks, a currency that was abolished after World War II. Even if bondholders can make a valid claim, the conversion rate and potential inflation adjustments make it difficult to assess the true value of the bonds today.

Financial Market for Old German Bonds

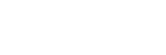

Despite these challenges, old German bonds continue to circulate, especially in niche markets for historical financial instruments. Collectors and investors often purchase these bonds as historical artifacts rather than as financial assets. In some cases, bonds issued during the Weimar period or the Nazi era have become highly sought-after collectibles due to their historical significance, unique designs, and the stories they represent.

Certain investors still hold onto these bonds in the hope that they may one day be redeemed. While the German government has consistently maintained that most of these bonds are no longer valid for redemption, the possibility of future legal actions or settlements remains. However, given the legal and financial complexities, the market for old German bonds remains speculative at best.

Recent Developments and Ongoing Disputes

In recent years, there have been renewed efforts by some bondholders to seek repayment, particularly in the United States. A number of lawsuits have been filed against the German government, claiming that it still owes billions of dollars in unpaid debt from these old bonds. Germany has consistently fought these claims in court, arguing that the debts have either been settled or are no longer valid under international agreements.

One notable case involved U.S. bondholders who sued Germany in the early 2000s, arguing that their bonds, which had been issued during the Weimar Republic, should still be redeemed. The courts, however, largely sided with Germany, ruling that the bonds were either restructured or effectively canceled as part of post-war debt settlements.

Despite these legal battles, most experts agree that the chances of successful bond redemption for individual holders remain slim. The German government has shown little willingness to revisit the issue, and the legal hurdles are significant.

A Legacy of Debt and Redemption

The story of old German bonds is one of historical significance, legal intricacy, and financial complexity. While some bonds have been redeemed through international agreements and settlements, many individual holders have been left without recourse. As time passes, the chances of redemption diminish, leaving most old German bonds as historical artifacts rather than viable financial assets.

For collectors, these bonds represent a fascinating period in global financial history—a reminder of Germany’s turbulent 20th century and the challenges of sovereign debt management. For investors, however, the legacy of these bonds serves as a cautionary tale of the risks associated with government-issued debt during periods of political and economic instability.

In the end, the redemption of old German bonds is a subject that intertwines legal, financial, and historical narratives, illustrating the complex nature of sovereign debt and the far-reaching impact of historical events on modern finance.