In the intricate web of the global economy, oil remains a critical driver of growth and a source of geopolitical tension. As the world’s largest oil importer, China’s oil demand dynamics provide significant insights into the intersection of economic recovery and energy consumption. This white paper explores China’s post-pandemic oil demand resurgence and its implications for global oil markets, financial landscapes, and broader geopolitical arenas.

Economic Recovery and Oil Demand

The COVID-19 pandemic caused unprecedented disruptions, leading to historic price volatilities and demand contractions in the oil sector. However, as global economies rebound, China’s robust recovery has led the charge, significantly impacting global oil demand. The nation’s rapid industrialisation, expansive infrastructure initiatives, and burgeoning middle class continue to drive its substantial oil consumption.

Strategic Sourcing and Geopolitical Shifts

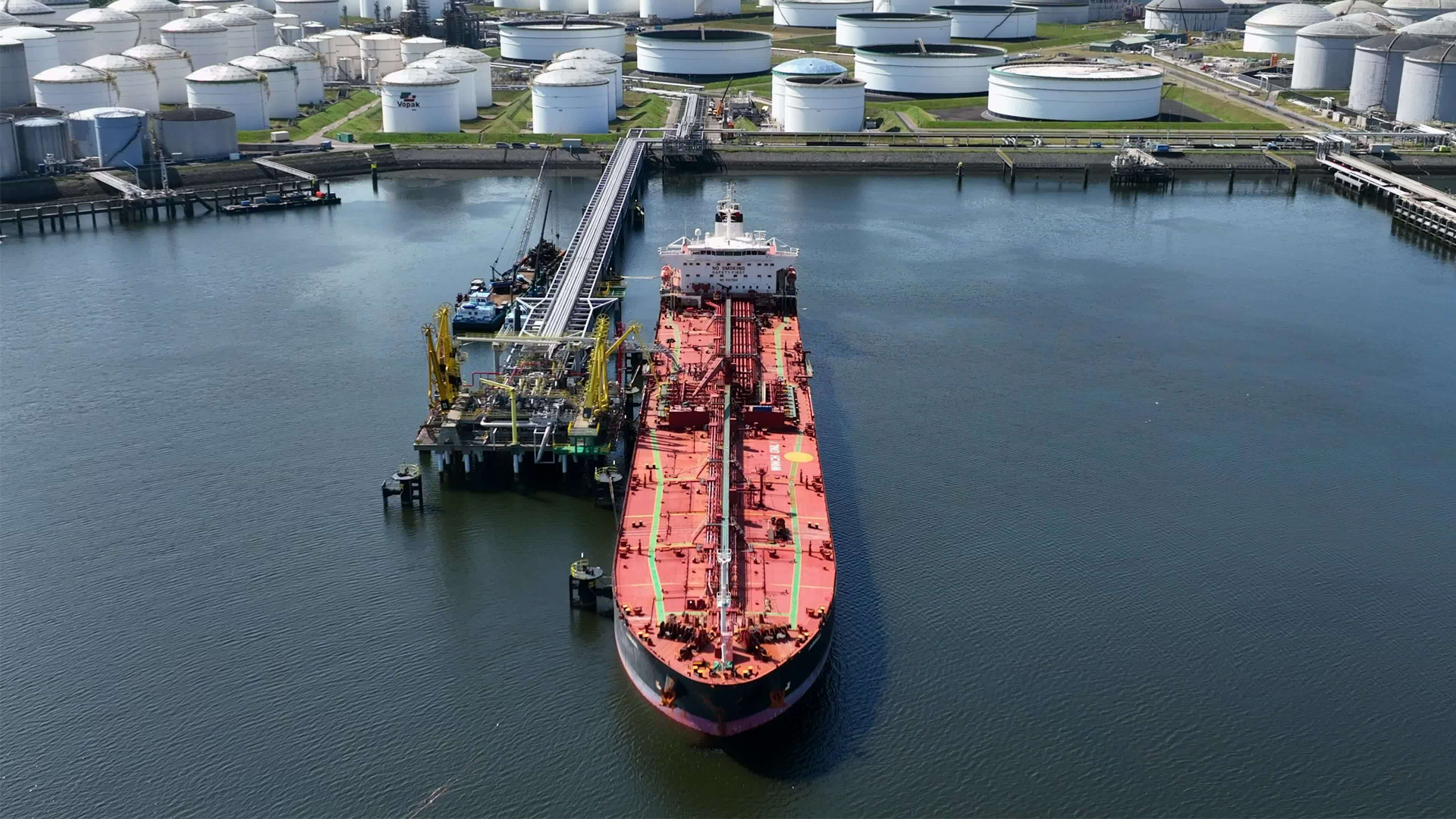

China’s strategic approach to securing oil supplies through partnerships with key oil-producing nations, particularly Russia, underscores its dual goals of economic security and global influence. These strategic manoeuvres reflect China’s pragmatic economic policies and its broader geopolitical ambitions.

Global Demand and Supply Dynamics

China’s oil demand resurgence has had profound impacts on global oil prices and market stability. The International Energy Agency (IEA) revised its global oil demand forecasts upwards, attributing a significant portion to China’s increased consumption. This demand surge has also influenced supply dynamics, with OPEC adjusting production levels to maintain market equilibrium.

Financial Market Implications

From a financial perspective, China’s oil demand trajectory serves as a barometer for global economic health and energy market trends. The country’s strategic sourcing decisions and increased consumption have ripple effects across various sectors, influencing energy stocks, commodity markets, and international trade dynamics. Investors closely monitor China’s economic indicators and policy decisions to inform their strategies.

Technological and Environmental Frontiers

The rise of electric vehicles (EVs) and renewable energy sources heralds a potential decline in oil dependency. China’s significant investments in these technologies are poised to reshape the energy landscape, presenting both challenges and opportunities for traditional oil markets. This transition towards sustainable energy sources reflects China’s commitment to reducing carbon emissions and promoting environmental sustainability.

Prospective Trends and Future Outlook

China’s strategic actions will continue to shape global oil demand and supply dynamics. The country’s efforts to secure long-term oil supplies through strategic partnerships and investments, coupled with its robust economic recovery, suggest a complex future trajectory for the global energy market. Stakeholders must navigate these developments with informed strategies to ensure sustainable growth and resilience.

China’s oil demand dynamics are a critical determinant of global energy markets. The nation’s economic strategies, technological advancements, and regulatory shifts will shape the future trajectory of global oil demand. By understanding these dynamics, stakeholders can make informed decisions, mitigate risks, and capitalise on opportunities. Adopting strategic recommendations that align with global sustainability goals will be crucial for achieving long-term success in an evolving energy landscape.